child tax credit september 2021

The enhanced child tax credit increased from 2000 to 3000 per child 17 and under and 3600 for kids under age six for the 2021 tax year. How much will parents receive in September.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children.

. 112500 if filing as head of household. Read customer reviews best sellers. Children who are adopted can.

Children who are adopted can also qualify if theyre US citizens. Distribution Tables by Income Level. The 2021 advance was 50 of your child tax credit with the rest on the next years return.

The irs is giving vague answers to people calling In. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. The Child Tax Credit provides money to support American families.

Here is some important information to understand about this years Child Tax Credit. Extension of the American. Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17.

Temporarily allows 17-year-old children to qualify for the credit. We dont make judgments or prescribe specific policies. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per.

An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17.

Enhanced funds were distributed on a monthly basis to help ensure struggling families a more constant stream of guaranteed income. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. That depends on your household income and family size.

Something is wrong with the ChildTaxCredit its not hitting millions of peoples bank accounts like it should. If you have a baby in 2021 your newborn will count toward the child tax credit payment of 3600. T21-0224 Tax Benefit of the Child Tax Credit CTC Current Law by Expanded Cash Income Level.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. The credit is not a loan. In 2021 only the federal child tax credit was temporarily boosted to a maximum of 3600 per child under President Bidens plan.

Ad E-File Your Taxes for Free. The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of cash to millions of families. Max refund is guaranteed and 100 accurate.

Thats up to 7200 for twins This is on top of payments for. The IRS has confirmed that theyll soon allow claimants to adjust their. Aggregate tax expenditure amount billions for the child tax credit CTC for calendar years 2022-25 under three scenarios.

Congress fails to renew the advance Child Tax Credit. Ad Free means free and IRS e-file is included. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Nearly every family is eligible to receive the 2021 CTC this year including families that havent filed a tax return and families that dont have recent income. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for. September 16 2021 735 AM MoneyWatch.

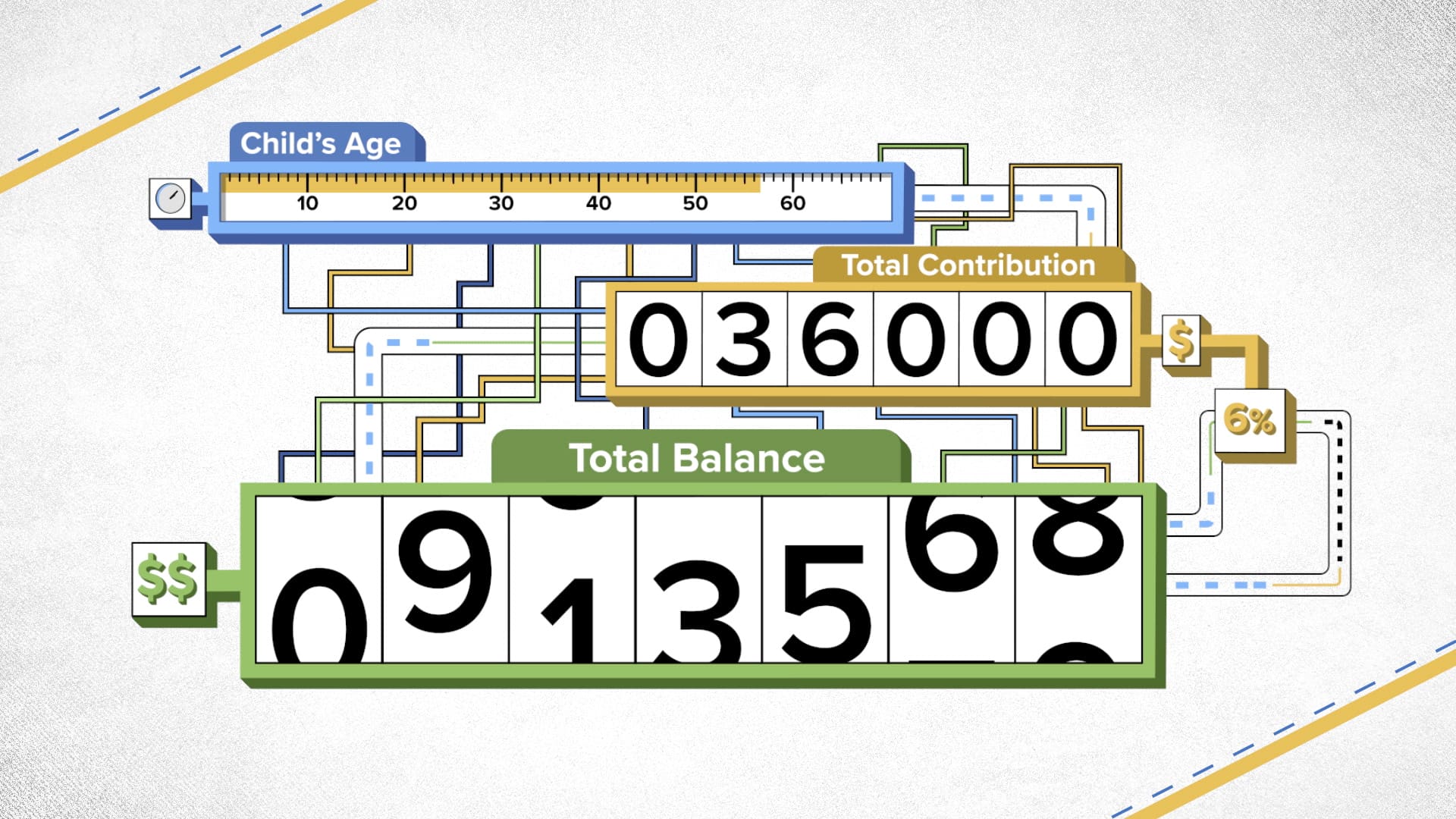

150000 if married and filing a joint return or if filing as a qualifying widow or widower. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. IRS sends third child tax credit payments around 15 billion to 35 million families VIDEO 906 0906 How a couple living in.

The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. See what makes us different. Childtaxcredit POTUS IRSnews Stop tweeting and actually read what the majority of the American public is saying.

IR-2021-188 September 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of September. Eligible families can receive a total of up to 3600 for each child under 6 and up to 3000 for each one age 6 to 17 for 2021. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Ad Browse discover thousands of unique brands. Removes the requirement that households must earn at least 2500 to receive the credit.

2021 Child Tax Credit Advanced Payment Option Tas

Latest Updates Accounting Services Secretarial Services Consulting Business

Latest Updates Accounting Services Writing Sayings

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Attention Californiahvac Contractors We Now Offer Services To Assist You With Your Californiaenergycode Compliance Cf2r P Time Management Paperwork Coding

Child Tax Credit Has Cut Food Hardship For 3 3 Million Families So Far

80 Cool Photos Of Resume Cover Letter Examples For Child Care Check More At Https Www Ourpetscrawley Com 80 Cool Photos Of Resume Cover Letter Examples For Ch

Mcq 211 Concept Assessment Test Civil Construction

Childctc The Child Tax Credit The White House

Daily Banking Awareness 20 21 And 22 December 2020 Awareness Banking Financial

Infosys Deadline To Fix Tax Filing Portal Is September 15 India S Tax Deadline Is 15 Days After Tax Deadline Filing Taxes Wealth Planning

Kiplinger S Retirement Report July 2013 Magazine Get Your Digital Subscription

Banking Financial Awareness 13 14 15th September 2020

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Bankruptcy Chapter 13 Chapter 13 Financial Management Chapter