child tax credit payment schedule 2021

September 24th 2021 0858 EDT. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

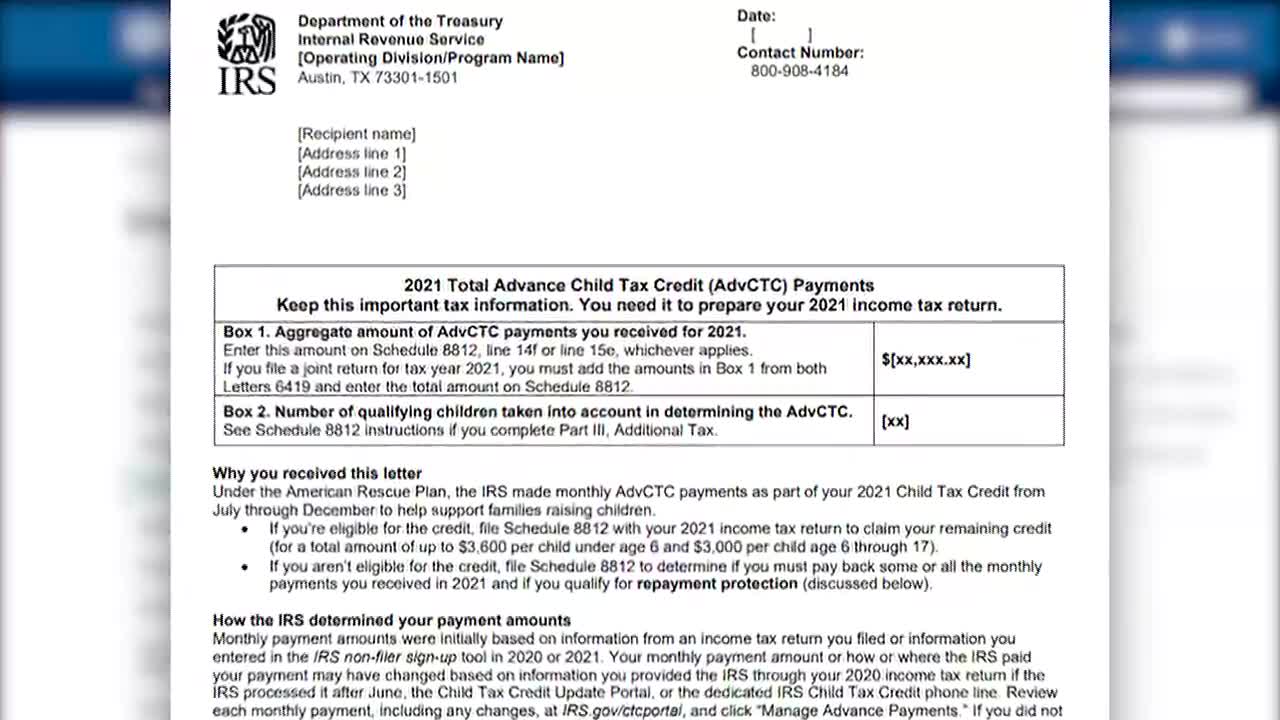

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Wciv

Wait 10 working days from the payment date to contact us.

. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17. For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. Schedule 8812 Form 1040 is now used to calculate child tax credits and to report advance child tax credit payments received in 2021 and to figure any additional tax owed if excess advance child tax credit payments were received during 2021.

Instead you will receive one lump sum payment with your July payment. Eligible families began to receive payments on July 15. Complete Edit or Print Tax Forms Instantly.

100 of the credit amount you received. The amount of credit you receive is based on your income and the number of qualifying children you are claiming. What To Do If The IRS Child Tax Credit Portal Isnt Working.

Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child. If your line 19a amount is your payment based on your 2021 Empire State child credit is. Visit ChildTaxCreditgov for details.

Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100. 15 opt out by Aug. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Child Tax Credit Payment Schedule for 2021. 15 opt out by Oct. 35 for incomes over 231250 462500 for married couples filing jointly.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The credit amount was increased for 2021. The Child Tax Credit Update Portal is no longer available but you can see your advance payments.

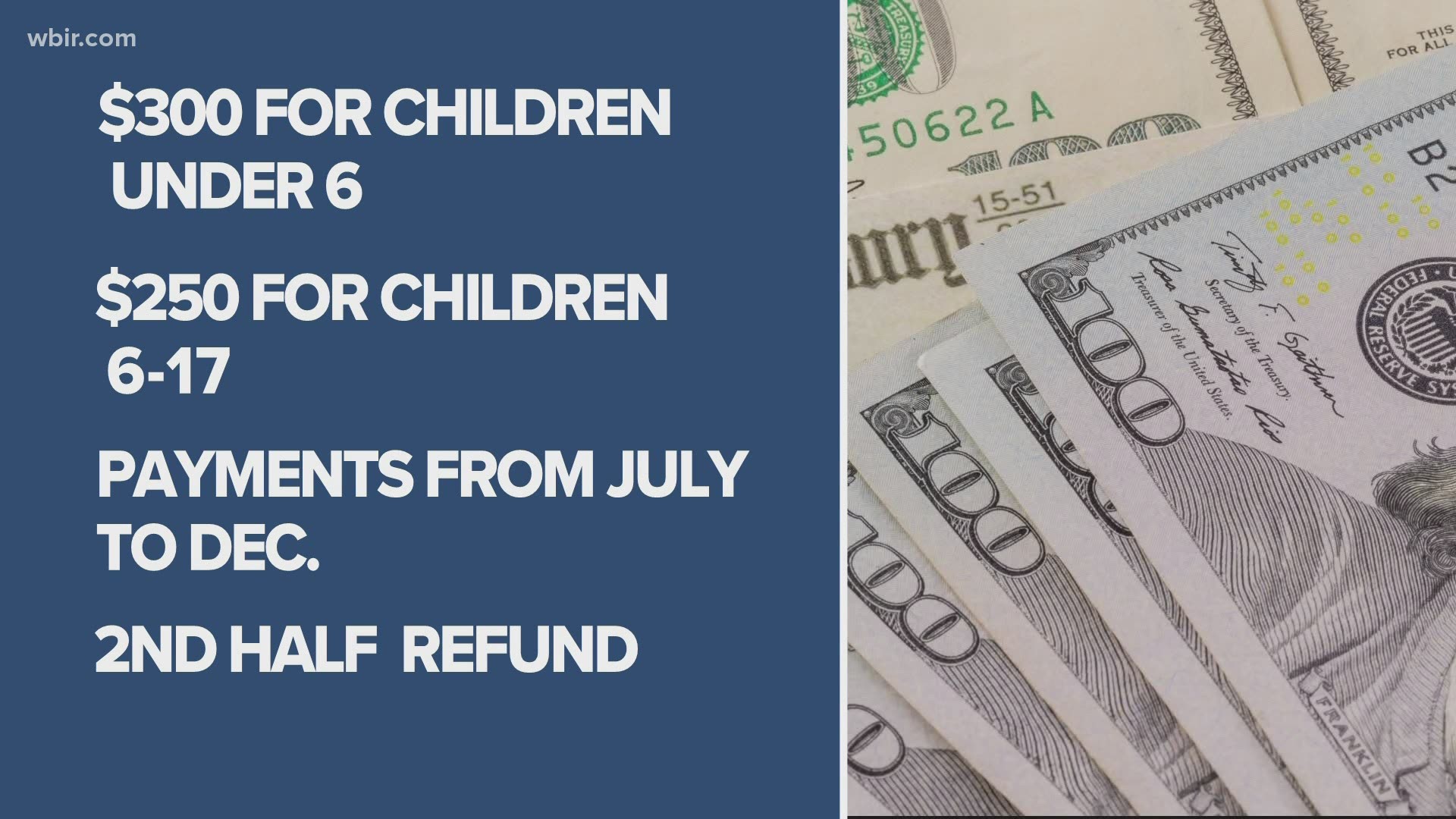

2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above. There have been important changes to the Child Tax Credit that will help many families receive advance payments. The IRS pre-paid half the total credit amount in.

The American Rescue Plan Act ARPA of 2021 expands the Child. The schedule of payments moving forward will be as follows. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. 15 opt out by Nov.

You will not receive a monthly payment if your total benefit amount for the year is less than 240. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Filers can also earn 100 per.

And 3000 for children ages 6 through 17 at the end of 2021. Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. Oliver Povey Olabolob Update.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The schedule of payments moving forward is as follows. Change language content.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The advance is 50 of your child tax credit with the rest claimed on next years return. The IRS recently released the new inflation adjusted 2023 tax brackets and rates.

The credit was made fully refundable. These updated FAQs were released to the public in Fact Sheet 2022-32 PDF July 14 2022. Three payments of the credit have already been sent out and three more are to come in 2021 with the next one due on October 15.

Wait 5 working days from the payment. Equal to or greater than but less than. Ad Save Time Adding Watermark in Online PDF.

3600 for children ages 5 and under at the end of 2021. Payments begin July 15 and will be sent monthly through. 13 opt out by Aug.

The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child Tax Credit that the IRS estimated you may properly claim on your 2021 tax return during the 2022. Alberta child and family benefit ACFB All payment dates. Empire State child credit additional payment computation table.

November 25 2022 Havent received your payment. The other rates are. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

75 of the credit.

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Child Tax Credit December 2021 How To Track Your Payment Marca

Child Tax Credit Payments What S Next

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Liberty Tax Here S A Breakdown Of What To Expect With The 2021 Child Tax Credit Payment Schedule Sidenote If You Have A Baby In 2021 Your Newborn Will Count Toward The

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Tas Tax Tips Early Information About Advanced Child Tax Credit Payments Under The American Rescue Plan Act Taxpayer Advocate Service

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

Child Tax Credit You Can Opt Out Of Monthly Payment Soon King5 Com

Child Tax Credit 2021 Payment Dates Youtube

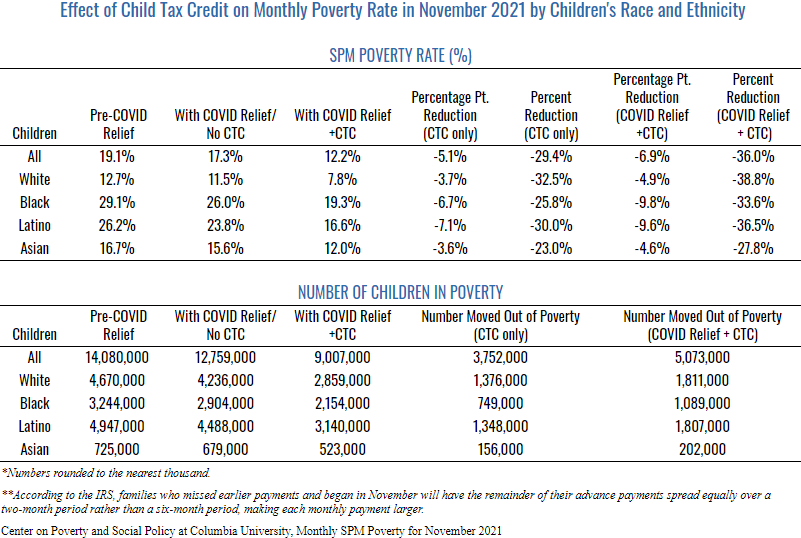

November Child Tax Credit Payment Kept 3 8 Million Children From Poverty Columbia University Center On Poverty And Social Policy

2021 Child Tax Credit Payments Irs Notice Youtube

2021 Child Tax Credit Advanced Payment Option Tas

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Child Tax Credit Checks These Are The Dates The Irs Plans To Send Payments Rochesterfirst